The Palmer Discretionary Account: 10 Reasons to Find Out More

The people at Joseph Palmer & Sons (Palmer’s) have long believed investing should not only be safer but also easier. That’s why increasing numbers are signing up to the Palmer Discretionary Account (PDA).

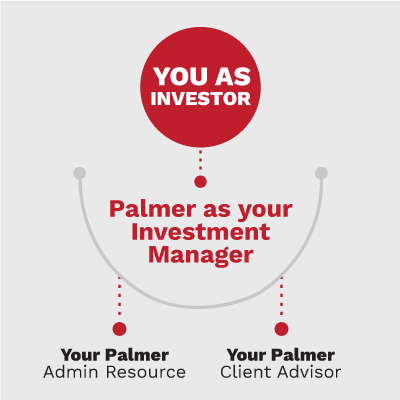

Our PDA is a service that greatly simplifies your inputs as an investor. While the process is described below, the best way to think of a Palmer Discretionary Account is to consider it as a journey: you know where you want to go (building your wealth while preserving your capital) - and the PDA is Palmer’s process to get you there. In short, you define, we implement.

There are 10 reasons why you will benefit from a PDA – and here they are:

- You define your investment objectives assisted by your own senior account manager at Palmer’s (whom you can contact directly by phone or email.)

- You and your account manager discuss and agree on a strategy to achieve your goals.

- You instruct (give discretion) to Palmer’s to implement and maintain your strategy within agreed limits that you set.

- Palmer’s researches and selects securities for your PDA portfolio based on the firm’s unique relative value analysis process which identifies safe yet un¬dervalued financial instruments.

- All the tax advantages accrue to you as the investor (and are neither shared nor used to subsidise others).

- Advanced technology underpins sophisticated administration, including automatically produced tax records and everything is accessible to you online 24/7.

- Sophisticated analysis techniques to optimise returns and reduce risks prevail.

- All investment procedures are in accord with the Integrity Rules of the Stock Market and overseen by an independent Invest-ment Committee.

- Palmers is a financial house renowned for its integrity and investment skills and has been advising Australians on wealth creation since 1872.

- Fees are transparent and low because your account manager does not receive commissions or trailing fees.

Having a Palmer Discretionary Account delivers a huge amount of convenience for little cost.

Call for a no-obligation chat today and learn how Palmer’s have developed a range of core portfolios to match your exact needs.

Remember, all the assets in your PDA are held in your name – you get all the benefits of direct ownership and tax advantages.

As a first step, call Ron Stephens on 02 8224 3324 now or email him: ronstephens@jpalmer.com.au

These are ten good reasons why you’ll never regret it.

Disclaimer & General Advice Warning

This publication has been prepared by Joseph Palmer & Sons (ABN 29 548 490 818) an Australian Financial Services Licensee (AFSL 247067). Whilst the information contained in this publication has been prepared with all reasonable care from sources, which Joseph Palmer & Sons believes are reliable, no responsibility or liability is accepted by Joseph Palmer & Sons for any errors or omissions or misstatements however caused. Any opinions, forecasts or recommendations reflects the judgment and assumptions of Joseph Palmer & Sons as at the date of publication and may change without notice. Joseph Palmer & Sons, their officers, agents and employees exclude all liability whatsoever, in negligence or otherwise, for any loss or damage relating to this document to the full extent permitted by law. This publication is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment. Any securities recommendation contained in this publication is unsolicited general information only. Joseph Palmer & Sons are not aware that any recipient intends to rely on this publication and are not aware of the manner in which a recipient intends to use it. In preparing our information, it is not possible to take into consideration the investment objectives, financial situation or particular needs of any individual recipient. Investors must obtain individual financial advice from their investment advisor to determine whether recommendations contained in this publication are appropriate to their personal investment objectives, financial situation or particular needs before acting on any such recommendations.

Number of views (5756)/